net investment income tax brackets 2021

There are seven federal tax brackets for the 2021 tax year. 10 12 22 24 32 35 and 37.

Tax Structure Tax Base Tax Rate Proportional Regressive And Progressive Taxation

41675 for married couples filing separately.

. Stay in a low tax bracket. 83350 for married couples filing jointly. Ad Tax Calculator for HOH Single and Married filing Jointly or Separate.

265 24 of income over 2650. Single taxpayers with taxable income of 41675 or less in 2022 qualify for a 0 tax rate on qualified dividends and capital gains. The Net Investment Income Tax is a 38 surtax that applies if you have investment income and your modified adjusted gross income MAGI is above a.

These are the rates for. The adjusted gross income. For Income-Seeking Investors the Challenge of Finding Durable Income Is a Major Worry.

Ad Become Expert in Investment - Investment Learning Quick FREE Updated 2022. FREE Investment Tutorials - Investment Course - Be Investment Certified 100. 2021 Federal Income Tax Brackets.

Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income. 2021 Form 8960 Author. Ad Capital Group Offers Bond Funds That Can Help Keep Portfolios Balanced Amid Volatility.

B the excess if any of. A Married Filing Jointly household has 300000 in income from self-employment and. An additional Medicare tax of 09 also applies to earned income subject to employment taxes.

Tax rate Single Married filing jointly Married filing separately Head of household. 10 12 22 24 32 35 and 37. For Income-Seeking Investors the Challenge of Finding Durable Income Is a Major Worry.

Capital gains tax rates on most assets held for a year or less correspond to. 26 tax rate applies to income. The federal income tax rates remain unchanged for the 2021 and 2022 tax years.

The investment income above the 250000 NIIT threshold is taxed at 38. In the case of an estate or trust the NIIT is 38 percent on the lesser of. Your capital gains rate is 0 for the 2022 tax year provided your income does not exceed.

Your 2021 Tax Bracket To See Whats Been Adjusted. Highest tax bracket for estates and trusts for the year see instructions. Ad Compare Your 2022 Tax Bracket vs.

Complete Edit or Print Tax Forms Instantly. The income brackets though are adjusted slightly for. Net Investment Income Tax Individuals Estates and Trusts.

Here are the 2021 and 2022 federal income tax brackets. 2021 tax brackets are provided for those filing taxes in April 2022 or in October 2022 with an extension. Here are the 2021 US.

Your bracket depends on your taxable income and filing status. The net investment income tax an additional 38. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted.

Net investment income tax brackets 2021. 2020-2021 Capital gains tax. Discover Helpful Information And Resources On Taxes From AARP.

A the undistributed net investment income or. April 28 2021 The 38 Net Investment Income Tax. All About the Net Investment Income Tax.

Ad Capital Group Offers Bond Funds That Can Help Keep Portfolios Balanced Amid Volatility.

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

What Is Investment Income Definition Types Tax Treatments

Fin 100 Sophia Final Milestone 100 Correct In 2022 Cost Of Capital Cash Budget Investing

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Raymond Skjaerstad Business Taxation Management Small Business Deductions Income Tax Return Insurance Deductible

What Is Investment Income Definition Types Tax Treatments

How Are Dividends Taxed Overview 2021 Tax Rates Examples

What Is The The Net Investment Income Tax Niit Forbes Advisor

Pin By Carole Jones On Taxes How To Apply Dental Medical

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Take These 5 Steps For A Quicker And Bigger Tax Refund In 2022 Barron S Tax Preparation Tax Preparation Services Tax Services

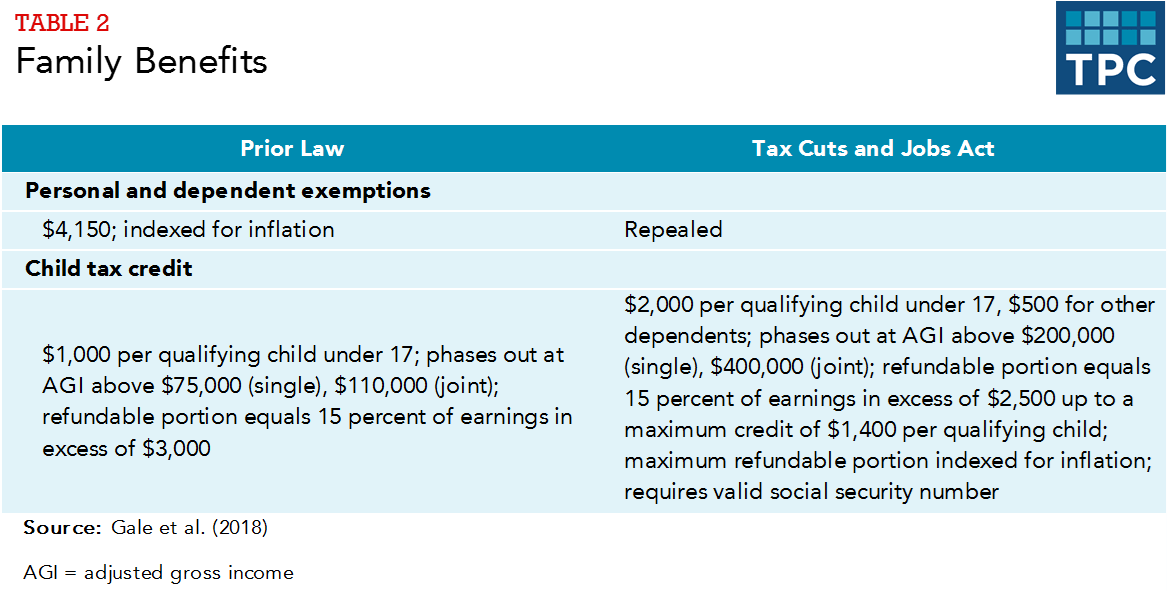

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Sources Of Personal Income In The United States Tax Foundation

Tax Calculator Estimate Your Income Tax For 2022 Free

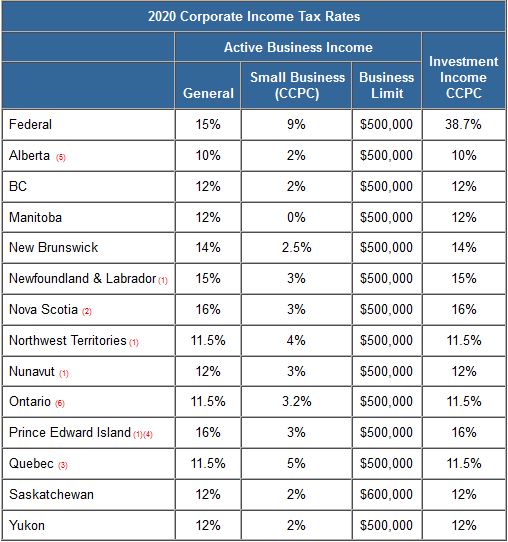

Taxtips Ca Business 2020 Corporate Income Tax Rates

Percentage Of Income Saved In July 2021 34 Reverse The Crush Blog Income Income Investing Money

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)